The Finnish Fine: Why a Speeding Ticket Could Cost Six Figures

In Finland, the penalty for speeding isn't a flat rate; it's based on your income, a system that has handed wealthy drivers single tickets for over $100,000.

Too Long; Didn't Read

TLDR: In Finland, speeding fines are linked to your income. Wealthy individuals can receive massive, six-figure tickets because the system is designed to ensure the financial punishment is equally impactful for everyone.

Pay What You Earn? Unpacking Finland's Famous Income-Based Speeding Tickets

Imagine getting a speeding ticket. Annoying, right? Now imagine that ticket costing you tens, or even hundreds, of thousands of euros. For some high earners in Finland, this isn't a hypothetical nightmare; it's a potential reality. But is it strictly true that Finland issues speeding tickets based directly on a driver's income? The idea often makes headlines and sparks debate about fairness and punishment. This post will dive into Finland's unique "day-fine" system to uncover the facts behind those eye-watering fines. We'll explore how the system works, why it exists, and what it means for drivers on Finnish roads.

What is the "Day-Fine" (Päiväsakko) System?

Finland employs a system called päiväsakko, or "day-fine," for penalties related to various offenses, not just speeding. This system has been in place in some form for decades, long predating recent viral stories.

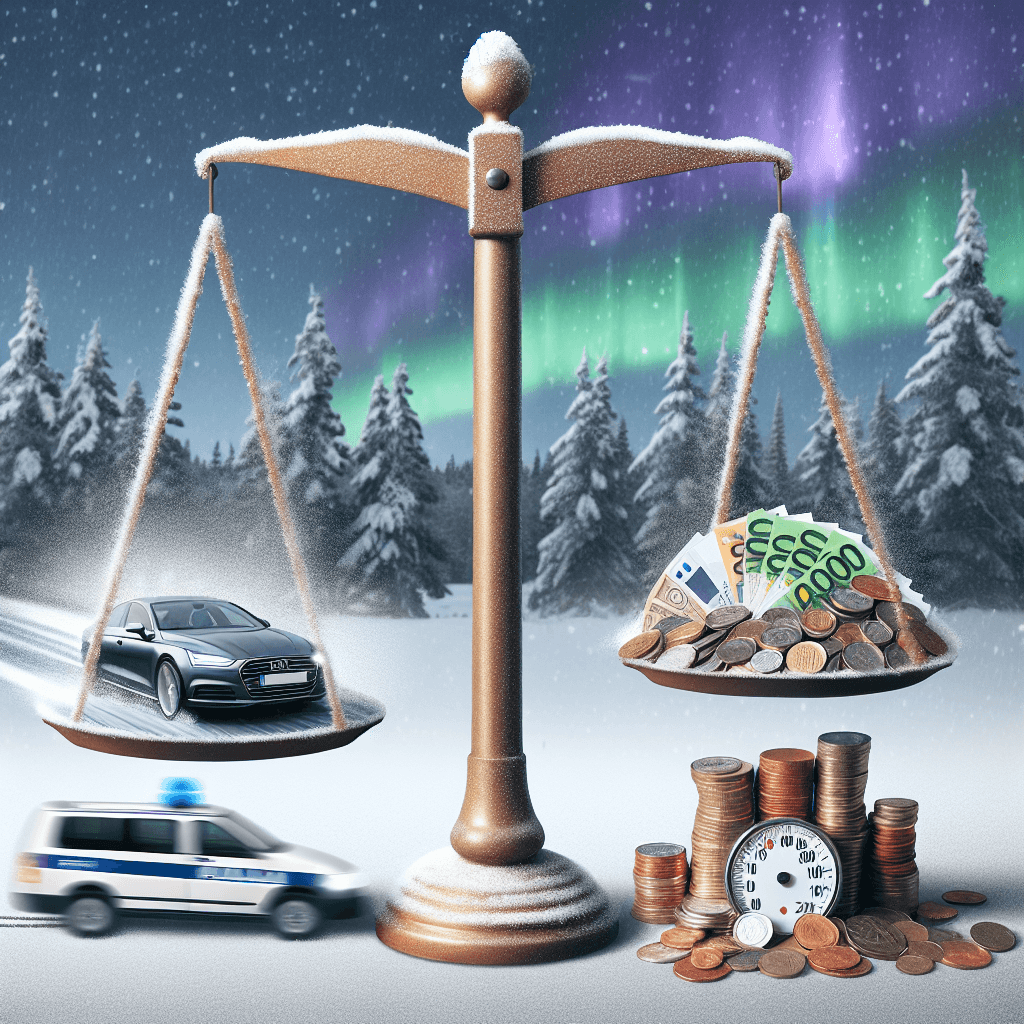

The core principle isn't about arbitrarily charging wealthy people more. Instead, it aims to ensure that the impact of the fine is proportionate across different income levels. The logic is that a €200 fine represents a significantly different level of hardship for someone earning minimum wage compared to a millionaire. The day-fine system attempts to equalize this punitive sting.

How Are Fines Calculated? It's About Severity and Income

The final amount on a Finnish day-fine ticket isn't just plucked from tax records. It's calculated based on two key factors:

- Severity of the Offense: The seriousness of the infraction determines the number of day-fines imposed. Minor speeding might result in a few day-fines, while a more serious violation warrants significantly more. For example, driving 21-25 km/h over the limit might typically result in 8 day-fines, whereas going 36-40 km/h over could mean 16 day-fines.

- Value of One Day-Fine: This is where income comes into play. The monetary value of a single day-fine is calculated based on the offender's daily disposable income.

Calculating the Daily Disposable Income

Authorities typically estimate this using the offender's most recent tax data. The calculation generally involves:

- Taking the person's monthly net income (after taxes).

- Subtracting a basic living allowance (a fixed amount set by law).

- Making further deductions for any dependent children.

- Dividing the remaining amount by 60 to arrive at a reasonable estimate of daily disposable income.

There's a legally defined minimum amount for a day-fine (currently €6), meaning even those with very low or no declared income face a minimum penalty.

So, the final fine = (Number of day-fines based on offense severity) x (Value of one day-fine based on calculated disposable income).

This means the fine is based on income, but calculated through a specific formula designed to represent disposable funds, rather than being a simple, direct percentage of total earnings.

The Rationale: Equal Impact, Not Just Equal Numbers

The philosophy underpinning the day-fine system is rooted in the concept of equitable punishment. Proponents argue:

- Fairness: It ensures fines have a comparable deterrent effect on offenders regardless of their wealth. A fixed fine system effectively penalizes the poor more harshly.

- Deterrence: Wealthy individuals might view small, fixed fines as merely the "cost of doing business," whereas a substantial income-based fine serves as a genuine deterrent.

Real-World Examples and Considerations

The system occasionally produces headline-grabbing fines for wealthy individuals caught speeding excessively. Reports of fines exceeding €50,000 or even €100,000 have surfaced over the years, often involving business executives or heirs.

However, the system isn't without debate:

- Accuracy: Income can fluctuate, and tax data might not always reflect current earnings accurately.

- Privacy: Relying on tax information raises privacy considerations for some.

- Perception: Some argue the system unfairly targets high earners or creates disproportionately large penalties.

It's also important to note that not all traffic violations fall under the day-fine system. Minor infractions might result in fixed penalty fees (rikesakko), similar to those in other countries.

Conclusion: Income Plays a Crucial Role, But It's Calculated

So, is it true Finland issues speeding tickets based directly on income? The answer is yes, but with important nuances. Finland uses a day-fine system where the monetary value of the fine is calculated based on an offender's estimated daily disposable income, derived from tax records and adjusted for basic expenses. The severity of the offense determines how many "days" of fines are issued. This system aims to make the financial penalty equally impactful for everyone, regardless of their bank balance. While it leads to occasionally staggering fines for the wealthy and sparks ongoing discussion about fairness, it's a long-established method designed to ensure traffic laws are respected across all socio-economic levels in Finland. It remains a fascinating example of a country attempting to legislate financial penalties with equity in mind.