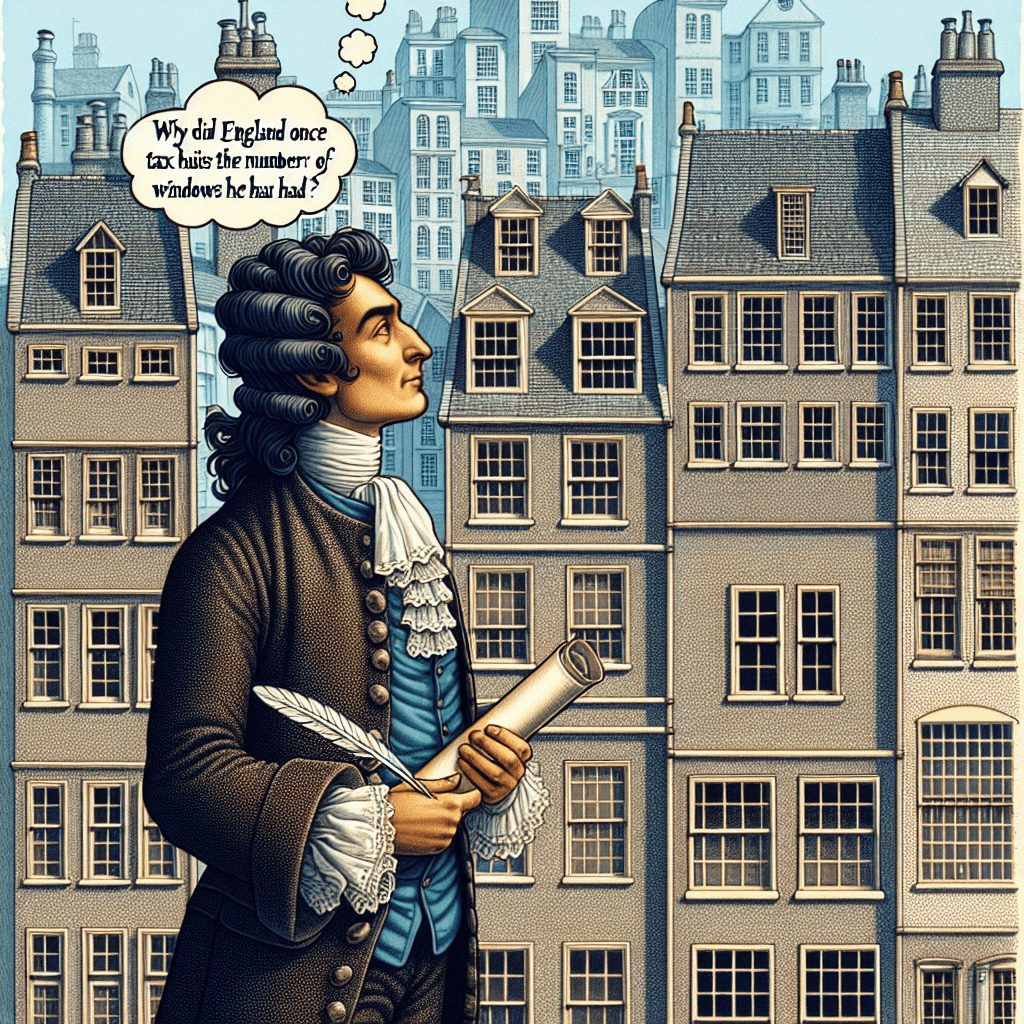

Daylight Robbery: Why England Once Taxed Houses by the Window

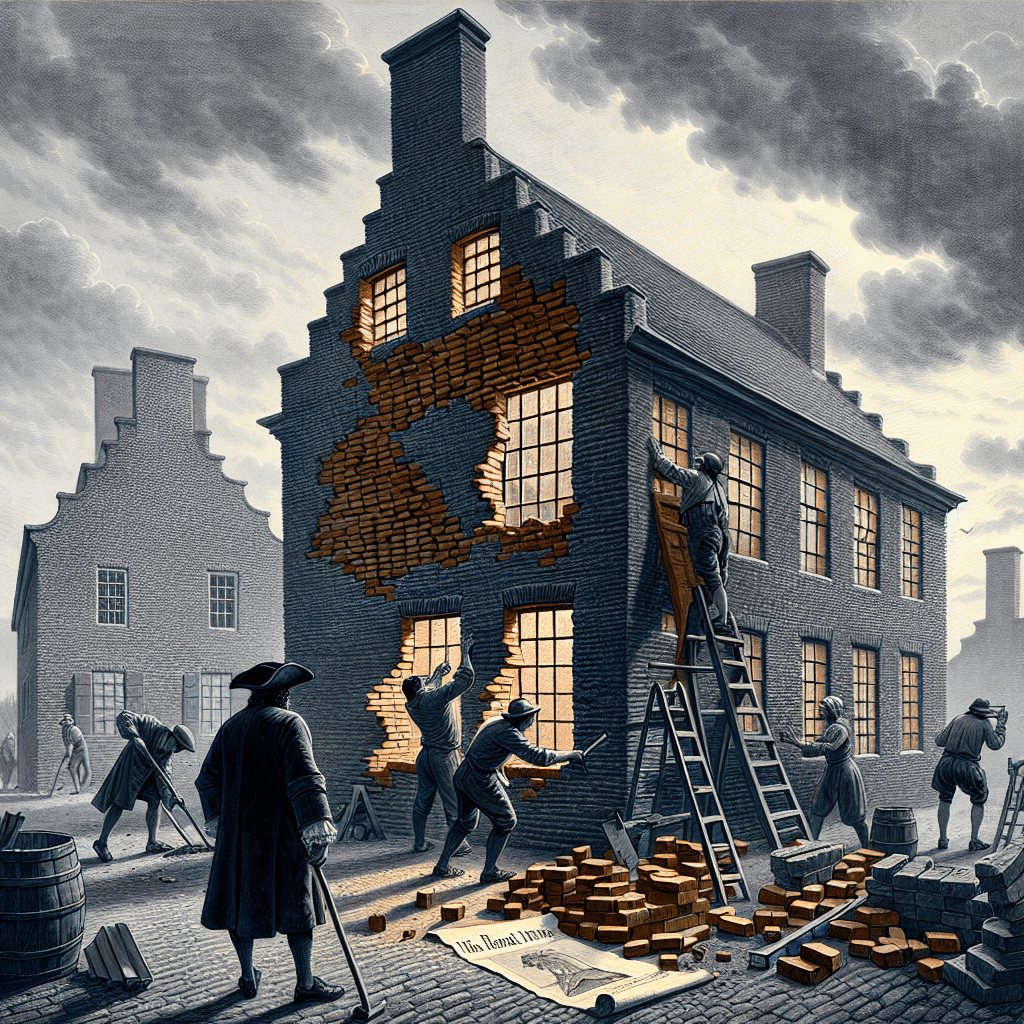

Ever wonder why old English buildings have bricked-up windows? It wasn't an architectural choice, but a clever way to avoid the infamous 'Window Tax' that literally put a price on daylight for over 150 years.

Too Long; Didn't Read

For over 150 years, England taxed homes based on how many windows they had. To avoid the tax, many people simply bricked up their windows.

Daylight Robbery: Why Did England Once Tax Houses Based on the Number of Windows They Had?

Imagine walking down a historic street in England and noticing bricked-up windows on otherwise elegant buildings. It seems architecturally odd, doesn't it? This wasn't always a design choice; often, it was a direct response to a peculiar and unpopular tax – the Window Tax. For over 150 years, the government literally taxed daylight. But why did England once tax houses based on the number of windows they had? This blog post explores the origins, impact, and eventual demise of this infamous levy.

The Window Tax was a significant feature of British fiscal policy from the late 17th century until the mid-19th century. Understanding why it was introduced requires looking at the economic and political climate of the time. This post will delve into the reasons behind its implementation, how it worked, its surprising consequences, and why it was ultimately abolished.

## The Search for Revenue: Why Tax Windows?

The Window Tax was introduced in England and Wales in 1696 under King William III. The primary driver was simple: the government needed money. England was engaged in costly wars, including the Nine Years' War, and traditional revenue streams weren't sufficient.

### The Problem with Income Tax

At the time, implementing an income tax was fraught with difficulties. There was strong opposition to what was seen as intrusive government snooping into personal finances. Furthermore, accurately assessing individual income was complex and easily evaded.

### Windows as a Proxy for Wealth

The government needed a tax that was relatively easy to assess and collect, and ideally, progressive – meaning the rich would pay more. Windows offered a seemingly clever solution:

- Visibility: Windows were easily visible from the outside, making assessment straightforward. Tax assessors didn't need to enter homes initially.

- Perceived Fairness: It was assumed that wealthier individuals lived in larger houses with more windows. Therefore, taxing windows seemed like a fair way to tax property wealth indirectly, hitting the affluent harder than the poor.

The tax was initially structured in two parts: a flat-rate house tax and an additional levy for properties with ten or more windows. Over time, the number of windows triggering the extra tax changed, and the rates increased significantly.

## How the Window Tax Operated

The system was relatively simple in principle:

- House Tax: A basic duty was levied on all inhabited houses.

- Window Duty: An additional, variable duty was charged based on the number of windows above a certain threshold (this threshold changed over the years, starting at ten).

Assessors would count the windows from outside the property. What constituted a "window" could be debated, sometimes including small openings or skylights, leading to disputes.

## Unintended Consequences: Bricking Up Britain

While intended as a relatively fair property tax, the Window Tax had significant and largely negative unforeseen consequences.

### Daylight Robbery - Literally

The most famous reaction was homeowners bricking up windows to avoid falling into a higher tax bracket. This is why you can still see the outlines of filled-in windows on many older buildings across Britain today. This practice led to the coining of the phrase "daylight robbery," initially used quite literally.

### Health Impacts

Blocking windows had severe consequences for public health, especially in poorer urban areas:

- Reduced Light and Ventilation: Dark, poorly ventilated homes became breeding grounds for diseases like typhus, smallpox, and cholera.

- Impact on the Poor: While intended to be progressive, landlords often passed the cost onto tenants or simply bricked up windows in tenement buildings, worsening living conditions for the poorest in society. Medical professionals at the time noted the correlation between lack of light and air and increased disease rates.

### Architectural Stagnation

The tax discouraged the use of glass and the construction of homes with ample windows, potentially hindering architectural innovation and the growth of the glass industry. Builders sometimes designed houses with fewer windows than aesthetically or functionally desirable.

## Opposition and Repeal

From its inception, the Window Tax was unpopular. Over the decades, opposition grew:

- It was increasingly seen as a "tax on light and air," essential elements for health and well-being.

- Reformers, doctors, and writers (including Charles Dickens) campaigned against it, highlighting its detrimental effects on public health and its unfairness, particularly to the urban poor.

- Arguments shifted towards the idea that taxes shouldn't penalize basic amenities necessary for a healthy life.

The mounting pressure, combined with a growing understanding of public health principles, finally led to the repeal of the Window Tax in 1851. It was replaced by a revised House Duty based on the property's rental value, considered a fairer assessment of wealth.

## Conclusion

So, why did England once tax houses based on the number of windows they had? It began as a pragmatic, if crude, attempt to raise government revenue in the late 17th century by taxing perceived wealth in a way that was easily assessable without invasive checks on income. Windows were chosen as a visible proxy for the size and grandeur of a property.

However, the Window Tax serves as a stark historical lesson in the unintended consequences of fiscal policy. Its legacy includes the bricked-up windows still visible today, but more importantly, it reminds us of the profound impact taxes can have on public health, social equity, and even the architectural landscape. It stands as a fascinating, if ultimately flawed, chapter in the history of taxation.