Why did people once pay the price of a house for a single tulip bulb

It wasn't just a flower—it was a status symbol so powerful and a speculative asset so volatile that people eagerly traded their homes for a single bulb before the market spectacularly imploded.

Too Long; Didn't Read

TLDR: In 17th-century Holland, a speculative frenzy over rare and exotic tulip bulbs created a massive economic bubble. Fueled by greed and hype, prices soared until a single bulb was worth a house, before the market inevitably crashed and bankrupted many investors.

Blog Post Title: The Flower That Broke the Market: Why Did People Once Pay the Price of a House for a Single Tulip Bulb?

Imagine a world where a single flower bulb is more valuable than a sprawling Amsterdam townhouse, a team of horses, or a lifetime of savings. This wasn't a fairy tale; it was the reality of the Dutch Golden Age during the 1630s. The phenomenon, known as "Tulip Mania," stands as one of history's most dramatic and perplexing speculative bubbles. It’s a story of beauty, greed, and economic folly that has fascinated historians and economists for centuries. This post will explore the unique combination of social, economic, and biological factors that transformed a simple garden flower into an object of unprecedented desire and financial ruin.

A New Symbol of Status

In the early 17th century, the Netherlands was experiencing its Golden Age. A burgeoning merchant class, flush with cash from international trade, was eager to display its newfound wealth. When the tulip arrived from the Ottoman Empire, it was unlike any flower Europeans had seen. Its intense, vibrant colors made it an instant sensation.

Initially, tulips were a hobby for wealthy botanists and aristocrats. However, as demand grew, they quickly became the ultimate status symbol. Owning rare tulips was a way for merchants to prove they had taste, sophistication, and, most importantly, immense wealth. The flower was no longer just a plant; it was a public declaration of success.

The Beauty of a 'Broken' Bulb

The real catalyst for the frenzy was a peculiar biological accident. A non-lethal virus, known as the mosaic virus, began infecting some tulip bulbs. This virus caused the petals to "break" their single-color monotony, creating stunning, unpredictable flame-like streaks and feathered patterns. These "broken" bulbs were coveted for their beauty and extreme rarity.

- Unpredictability: Growers couldn't create these patterns on demand. A prized broken bulb was a happy accident of nature, making it a limited-edition masterpiece.

- Rarity: The most famous varieties, like the legendary Semper Augustus with its crimson flames on a white background, were extraordinarily scarce. At the height of the mania, only a dozen or so bulbs were known to exist.

- Demand: This rarity, combined with their breathtaking appearance, made these broken bulbs the most sought-after of all.

From a Garden Hobby to a Futures Market

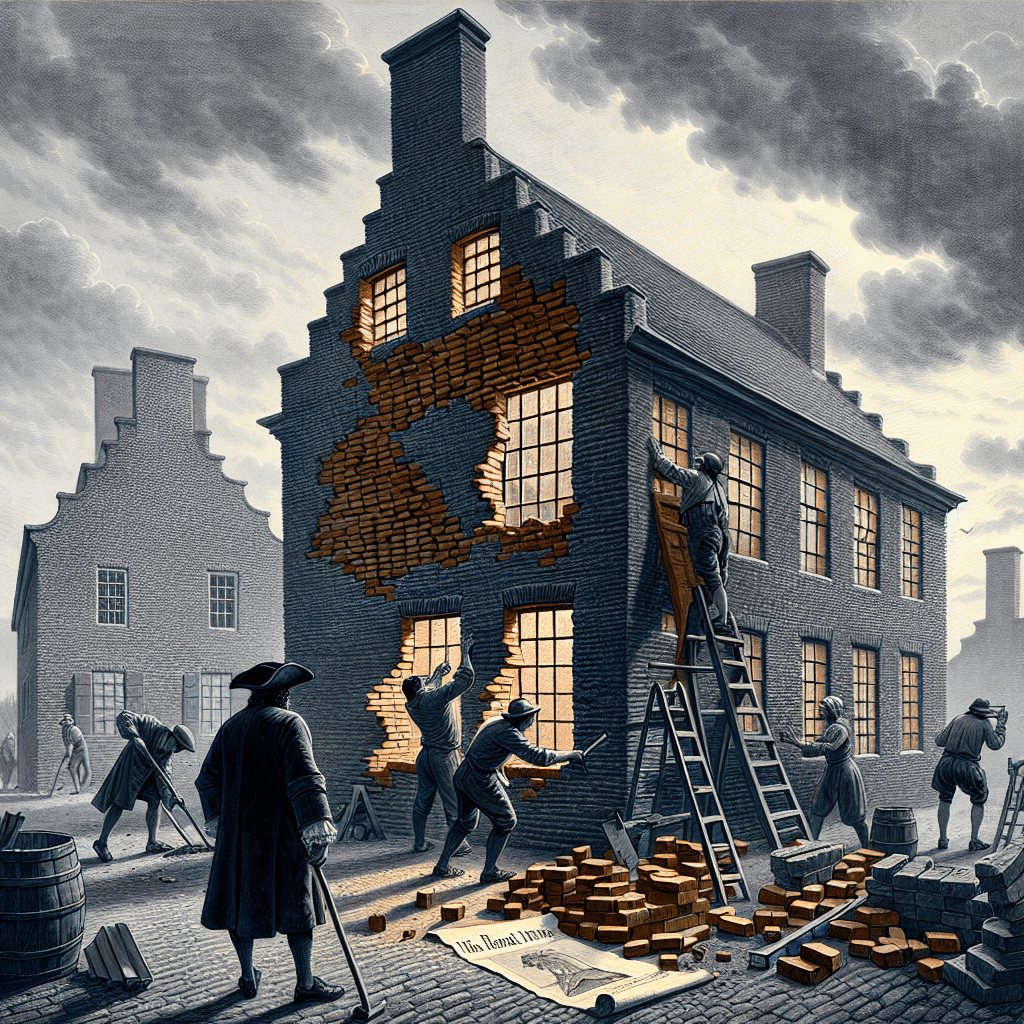

As prices began to rise, the nature of the tulip trade changed dramatically. What started as a cash-for-bulb transaction among enthusiasts evolved into a complex futures market. Because tulip bulbs can only be moved during their dormant season in the summer, traders in the winter of 1636-1637 began selling paper contracts for bulbs that were still in the ground.

This practice, known as windhandel ("wind trade"), allowed for rapid speculation. People were buying and selling not the flowers themselves, but the promise of a flower. Taverns in Dutch cities became informal stock exchanges where traders, many of whom had never seen a rare tulip, bid up contract prices to astronomical levels. The market was no longer driven by the flower's intrinsic beauty but by the belief that someone else would always be willing to pay more.

The Inevitable Crash

At its peak in the winter of 1636-1637, a single bulb of a prized variety like the Viceroy was famously traded for a package of goods worth more than a skilled craftsman's annual income, including oxen, pigs, tons of butter, and a ship. But this could not last.

In February 1637, the bubble burst. There was no single cause, but a general loss of nerve. When a group of sellers at a routine auction in Haarlem couldn't find any buyers, panic quickly spread. Everyone rushed to sell their contracts, but nobody was buying. Prices plummeted over 90% within weeks. Fortunes were wiped out overnight, leaving speculators with nothing but worthless paper contracts and a bitter lesson in market psychology. While modern historians note the mania didn't crash the entire Dutch economy, it financially ruined many individuals who had gambled their futures on a flower.

Conclusion

So, why did people pay the price of a house for a tulip bulb? It was a perfect storm of a new luxury product, a wealthy society eager for status symbols, and the creation of a speculative futures market detached from reality. The viral patterns that made the flowers so beautiful and rare lit the fuse, but it was human greed and the psychology of a speculative bubble that fueled the inferno. Tulip Mania remains a powerful cautionary tale about market bubbles, reminding us that when assets are priced on pure emotion and the "greater fool theory," the eventual crash is not a matter of if, but when.