Why were the very first credit cards actually made out of cardboard

Before the age of plastic and secure chips, the financial revolution began with a simple piece of cardboard, born from a forgotten wallet and an embarrassing dinner.

Too Long; Didn't Read

TLDR: The first credit cards in the 1950s were cardboard because it was a cheap and simple material. The cards only served as basic identification for a charge account, and the technology for mass-producing durable plastic cards wasn't common yet.

Before Plastic: Why Were the Very First Credit Cards Actually Made Out of Cardboard?

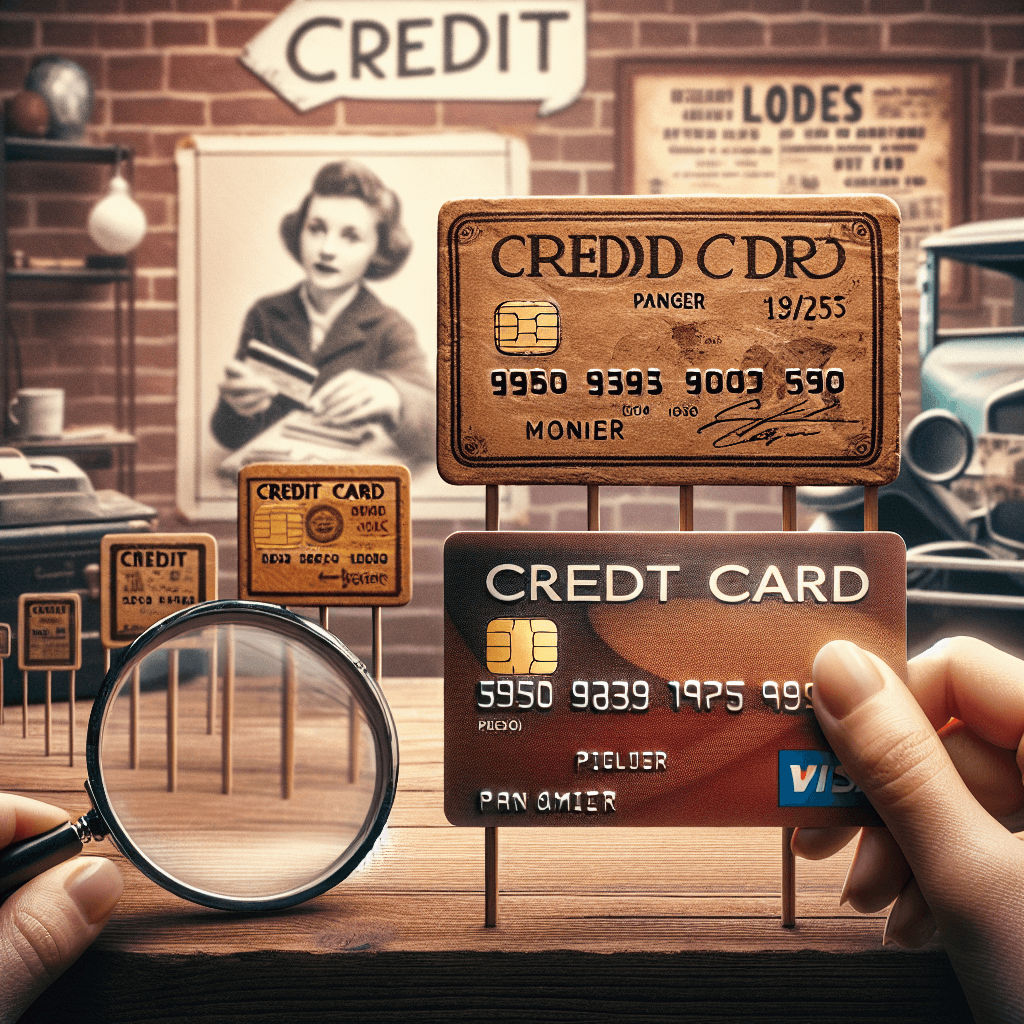

In an age of metal cards, digital wallets, and tap-to-pay technology, it’s almost impossible to imagine a credit card being made of anything but durable plastic or sleek metal. Yet, if you were to travel back to the dawn of the credit card era, you wouldn't find a single piece of plastic. Instead, you'd find a simple piece of cardboard. Why did this revolutionary financial tool have such a humble beginning? The answer lies in a blend of practicality, available technology, and the simple problem it was designed to solve. This post will delve into the fascinating history of the first credit cards and explain why cardboard was the material of choice for the financial pioneers who created them.

The "First Supper": The Birth of the Diners Club Card

The most famous origin story of the modern credit card begins in 1949. A New York businessman named Frank McNamara was hosting a dinner at Major's Cabin Grill and, upon receiving the bill, realized he had forgotten his wallet. This embarrassing moment sparked an idea. He envisioned a system where a trusted individual could present a single card at multiple establishments and settle the entire bill at a later date.

A year later, in 1950, he returned to the same restaurant and paid with a small cardboard rectangle—the very first Diners Club Card. This event, dubbed the "First Supper," marked the beginning of the multi-purpose charge card. The card wasn't about high-tech security; it was a simple voucher of credibility. It told the merchant that the Diners Club organization would guarantee payment, streamlining the billing process for both the customer and the restaurant.

Cardboard Convenience: The Practical Reasons for a Paper Progenitor

Given that the purpose was simply identification and deferred payment, cardboard was the perfect material for several key reasons. The choice was less about limitations and more about brilliant, pragmatic design for the era.

- Cost and Availability: In the mid-20th century, plastic manufacturing was not the cheap, ubiquitous process it is today. Cardboard and heavy paper stock, however, were inexpensive and incredibly easy to source and print on. For a fledgling company like Diners Club trying to launch a new concept, keeping production costs low was essential.

- Simple Functionality: The first credit cards had no electronic components. There was no magnetic stripe to swipe or chip to read. The transaction process was entirely manual. A merchant would simply look at the card, verify the name and expiration date, and write down the account number on a sales ledger. A simple, printed piece of cardboard was all that was needed to convey this information.

- Easy Distribution: The Diners Club business model relied on signing up members and mailing them their cards. Lightweight cardboard was cheap and easy to send through the post, making it ideal for a mail-based business.

- Planned Obsolescence: These early cards had short lifespans, often expiring annually. Using a disposable material like cardboard made sense. The company could simply mail out a new card each year upon membership renewal, ensuring their records were up-to-date and that only paid members had valid cards.

The Shift to Plastic: Durability and the Rise of the "Imprinter"

While cardboard was a perfect starting point, its weaknesses quickly became apparent. The cards were flimsy, easily damaged by water, and could wear out quickly in a wallet. More importantly, as the volume of transactions grew, the manual process of writing down every account number became slow and prone to errors.

The true catalyst for change was the invention of the credit card "imprinter"—the classic "zip-zap" machine. This device required cards to have raised, or embossed, numbers. When a sales slip was placed over the card in the machine, a roller would press the slip against the card, creating a carbon-copy imprint of the customer's account information.

Cardboard couldn't be embossed effectively. This technological need paved the way for a more robust material: plastic. In 1959, American Express issued the first plastic credit card, and its durability and ability to be embossed quickly made it the new industry standard. Plastic was not only more resilient but also projected an image of permanence and professionalism that helped solidify the credit card's place in the consumer landscape.

Conclusion

The evolution from cardboard to plastic wasn't just a material upgrade; it mirrored the evolution of the financial industry itself. The first cardboard Diners Club card was a brilliant solution for its time—an inexpensive, practical tool for a simple but revolutionary idea. It solved a specific problem using the most logical resources available. As the system grew more complex and technology advanced with tools like the imprinter, the need for a more durable and functional material like plastic became essential. So, the next time you tap your phone or slide a chip card to pay, remember its humble cardboard ancestor—a testament to how the greatest innovations often start with the simplest of solutions.